Everyone dreams of financial freedom, but the path to becoming a millionaire can seem elusive. What if the secret to amassing wealth isn't about a drastic overhaul of your life but rather a tiny, consistent change? Many self-made millionaires have discovered that small adjustments can lead to monumental success over time. Let's dive into this approach, breaking it down into manageable steps that anyone can start today.

The Power of a Plan

The journey to a million starts with a plan. Think of it as your roadmap; without it, you're just driving aimlessly. A detailed financial plan helps you outline your goals, prioritize your spending, and make informed decisions about your money. It doesn't have to be complicated.

Start by setting clear, specific goals - what do you want your financial future to look like? A well-laid plan will keep you focused and help you avoid unnecessary detours.

Remember, successful people don't stumble upon wealth; they create a strategy and stick to it"‹ (InvestingAnswers).

Prioritize and Simplify Your Spending

One tiny change that can significantly impact your journey to becoming a millionaire is prioritizing your spending.

Many people fall into the trap of lifestyle inflation, where they start spending more as they earn more. Instead, live below your means.

This doesn't mean you should deprive yourself but focus on what truly matters. For example, Warren Buffett, one of the wealthiest people in the world, lives in the same modest house he bought decades ago.

His frugality allows him to invest more and accumulate wealth faster. Cutting down on unnecessary expenses frees up more money for saving and investing"‹ (The Financial Cookbook, LLC)"‹ (Mind By Design).

Multiple Streams of Income

A common trait among millionaires is their ability to generate multiple income streams.

Relying solely on one source of income is risky; if it dries up, you could be in trouble.

Most millionaires have diversified income streams, such as investments, side businesses, rental properties, or royalties.

This approach not only increases your earning potential but also provides a safety net in case one income stream falters.

Starting a side hustle or investing in stocks might seem small, but these can compound over time, significantly boosting your wealth"‹ (The Frugal Expat)"‹ (The Financial Cookbook, LLC).

Invest Early and Consistently

Investing is not just a millionaire's game - it's a powerful tool that anyone can use.

The earlier you start, the better, thanks to the magic of compound interest. Even small, regular investments can grow exponentially over time.

Many millionaires swear by dollar-cost averaging, where they invest a fixed amount regularly, regardless of market conditions.

This strategy not only simplifies the process but also reduces the risk of making poor investment decisions based on market fluctuations"‹ (InvestingAnswers).

Consider this: If you invest $100 a month in a diversified index fund with an average annual return of 7%, you could have over $120,000 in 30 years.

Now imagine if you could increase that amount as your income grows. The key is to start and to be consistent. As your investments grow, reinvesting dividends can accelerate your path to wealth"‹ (The Frugal Expat)"‹ (Mind By Design).

Protect Your Wealth

Building wealth is only half the battle; protecting it is equally important.

This includes having adequate insurance, such as health, home, and car insurance, to shield you from unexpected expenses that could derail your financial progress.

Additionally, consider estate planning and other legal protections to ensure your assets are safeguarded for the future.

It might seem like a small step, but ensuring your wealth is protected is crucial for long-term financial stability"‹ (InvestingAnswers).

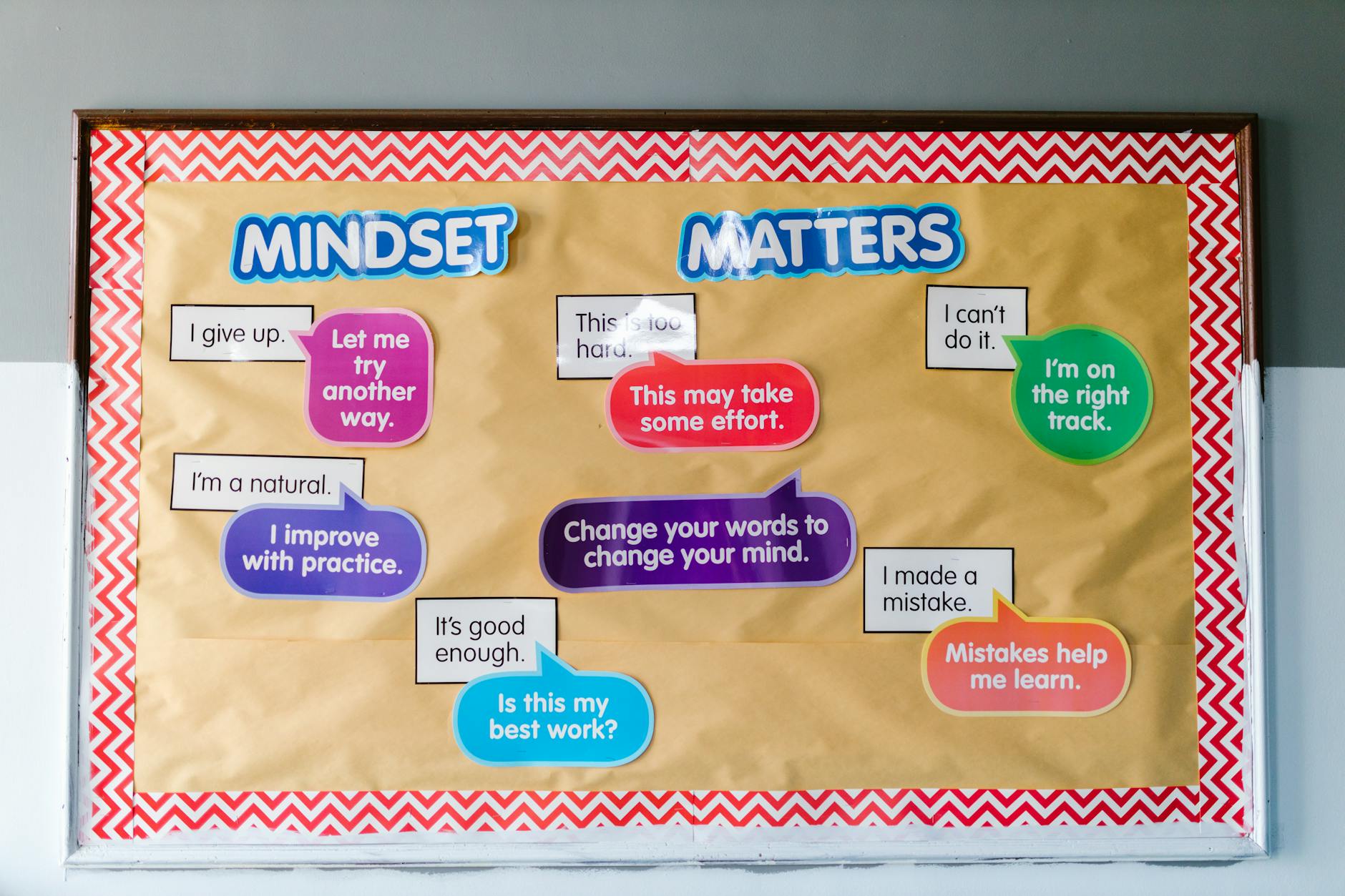

Adopt the Millionaire Mindset

Beyond tangible actions, adopting a millionaire mindset can make all the difference.

Millionaires aren't afraid of failure; they see it as a learning opportunity.

They remain positive and focus on long-term goals, understanding that wealth accumulation is a marathon, not a sprint.

They also avoid comparing themselves to others and remain disciplined in their financial habits. This mindset helps them stay on track, even when faced with challenges"‹ (Mind By Design).

For instance, think about someone like you or me who decided to start a side business after work.

At first, it might only bring in a few extra dollars each month, but over time, as they learn and grow, that side hustle could turn into a significant income stream, contributing to their journey to millionaire status.

The Tiny Change That Matters

So, what's the tiny change that could make you a millionaire? It's simple: Start now, no matter how small. Whether it's creating a financial plan, cutting unnecessary expenses, starting a side hustle, or making that first investment, these small steps, when compounded over time, can lead to incredible results. The road to wealth is paved with small, consistent actions that align with your goals.

The key is consistency. Like planting a tree, it starts as a small seed but, with time and care, grows into something massive. The same goes for your financial future. Start with that tiny change today, and watch it grow into something significant.

References

- Frugal Expat. "10 Habits of Self-Made Millionaires That Can Make You Rich." The Frugal Expat. thefrugalexpat.com

- Financial Cookbook. "11 Habits of Millionaires that Make Them Successful Every Day." The Financial Cookbook. thefinancialcookbook.com

- Mind by Design. "Thinking Like A Millionaire (17 Ways to develop the mindset to succeed)." Mind by Design. mindbydesign.io

- Investing Answers. "How To Turn Yourself Into A Millionaire In 5 Steps." InvestingAnswers. investinganswers.com

- Financial Cookbook. "11 Habits of Millionaires that Make Them Successful Every Day." The Financial Cookbook. thefinancialcookbook.com

Leave a Comment